How To Calculate Annual Rate Of Return In Excel

Rate of Render Formula(Table of Contents)

- Rate of Render Formula

- Rate of Render Calculator

- Rate of Render Formula in Excel (With Excel Template)

Rate of Return Formula

The Rate of return is render on investment over a flow information technology could be profit or loss. Information technology is basically a percentage of the amount above or below the investment amount. If the render of investment is positive that means there is a gain over investment and if the return of investment is negative that means there is a loss over investment. The rate of return is compared with proceeds or loss over investment. The rate of return expressed in course of percent and also known as ROR. The rate of return formula is equal to current value minus original value divided by original value multiply past 100.

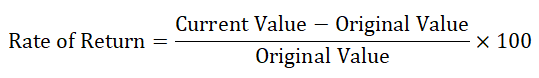

Hither's the Rate of Return formula –

Where,

- Current Value = Electric current value of investment.

- Original Value = Value of investment.

The charge per unit of return over a fourth dimension period of one yr on investment is known every bit almanac return.

Examples of Charge per unit of Return Formula

Let us see an example to empathize rate of return formula ameliorate.

Y'all can download this Charge per unit of Render Formula Excel Template hither – Rate of Return Formula Excel Template

Rate of Return Formula – Example #1

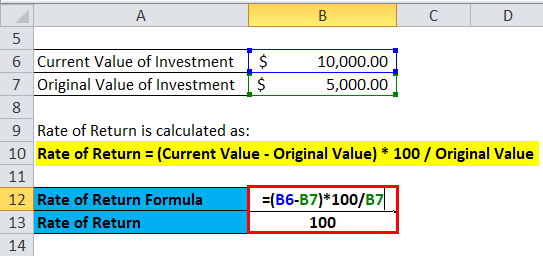

An investor purchased a share at a price of $5 and he had purchased 1,000 shared in twelvemonth 2017 after one twelvemonth he decides to sell them at a cost of $ten in the year 2018. Now, he wants to calculate the rate of return on his invested amount of $5,000.

As we know,

Charge per unit of Render = (Electric current Value – Original Value) * 100 / Original Value

Put value in the in a higher place formula.

- Rate of Return = (x * g – v * 1000) * 100 / 5 *thou

- Rate of Render = (x,000 – 5,000) * 100 / 5,000

- Rate of Render = five,000 * 100 / 5,000

- Charge per unit of Return = 100%

Charge per unit of return on shares is 100%.

Now, let's see another instance to understand the rate of render formula.

Charge per unit of Return Formula – Example #2

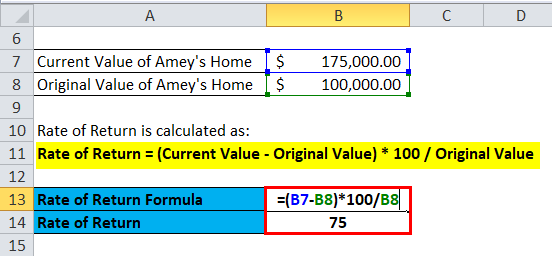

Amey had purchased domicile in year 2000 at price of $100,000 in outer area of city later on sometimes area got develop, various offices, malls opened in that area which leads to an increase in market place price of Amey's dwelling house in the twelvemonth 2018 due to his job transfer he has to sell his domicile at a price of $175,000. Now, let's summate the rate of return on his belongings.

As we know,

Rate of Return = (Current Value – Original Value) * 100 / Original Value

Put value in the in a higher place formula.

- Rate of Render = (175,000 – 100,000) * 100 / 100,000

- Charge per unit of Return = 75,000 * 100 / 100,000

- Rate of Return = 75%

Charge per unit of return on Amey's home is 75%.

Annualize Charge per unit of Render –

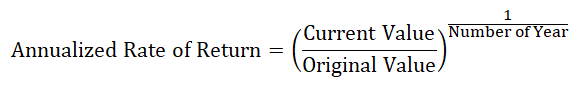

The regular charge per unit of return tells about the gain or loss of an investment over a period of time. Information technology is expressed in terms of percentage. The annualize rate on return also known as the Compound Almanac Growth Rate (CAGR). It is render of investment every year. The annualized rate of return formula is equal to Electric current value upon original value raise to the power ane divided by number of years, the whole component is then subtracted by i.

The formula for same tin be written as:-

In this formula, any gain made is included in formula.

Let u.s. come across an example to understand it.

Rate of Return Formula – Instance #3

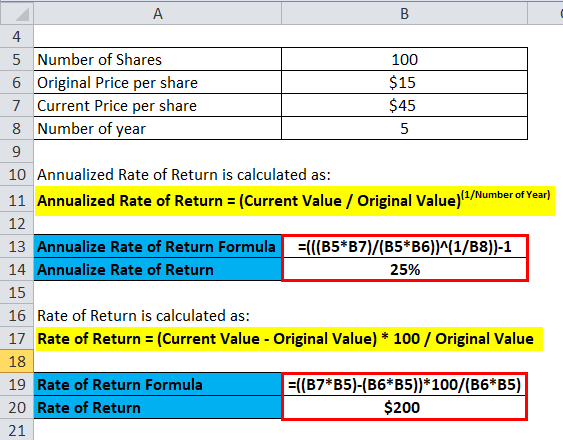

An investor purchase 100 shares at a price of $15 per share and he received a dividend of $two per share every year and after 5 years sell them at a cost of $45. At present, we have to calculate the annualized render for the investor.

As we know,

Annualized Rate of Return = (Current Value / Original Value)(1/Number of Year)

Put value in the formula.

- Annualized Rate of Return = (45 * 100 / xv * 100)(1 /5 ) – i

- Annualized Rate of Return = (4500 / 1500)0.2 – 1

- Annualized Rate of Render = 0.25

Hence,

Annualized Rate of Return = 25%

So, Annualize Charge per unit of return on shares is 25%.

Now, let u.s.a. calculate the rate of render on shares.

Charge per unit of Return = (Current Value – Original Value) * 100 / Original Value

Put value in formula.

- Rate of Return = (45 * 100 – fifteen * 100) * 100 / 15 * 100

- Rate of Return = (4500 – 1500) * 100 / 1500

- Rate of Return = 200%

Now, rate of return is 200% for shares.

Charge per unit of render is also known as return on investment. The rate of return is applicable to all type of investments like stocks, existent estate, bonds etc.

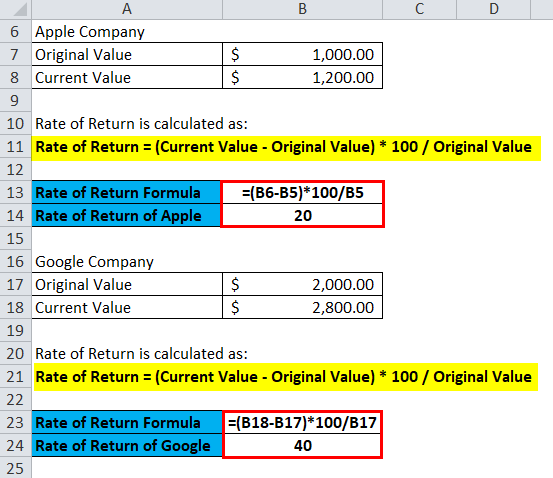

Charge per unit of Return Formula – Example #iv

Suppose an investor invests $1000 in shares of Apple tree Company in 2015 and sold his stock in 2016 at $1200.

Then, the rate of render will be:

- Charge per unit of Return = (Electric current Value – Original Value) * 100 / Original Value

- Rate of Return Apple = (1200 – 1000) * 100 / thou

- Rate of Return Apple = 200 * 100 / 1000

- Rate of Return Apple= twenty%

He also invested $2000 in Google stocks in 2015 and sold his stock in 2016 at $2800.

So the rate of return will exist as follows:-

- Rate of Render = (Electric current Value – Original Value) * 100 / Original Value

- Charge per unit of Return Google = (2800 – 2000) * 100 / 2000

- Charge per unit of Return Google = 800 * 100 / 2000

- Rate of Render Google = 40%

Then, through the rate of render, one can calculate the best investment option available. We tin encounter that investor earns more profit in the investment of Google then in Apple, equally the charge per unit of return on investment in Google is higher than Apple.

Significance and Utilise of Rate of Return Formula

Rate of return have multiple uses they are as follows:-

- Charge per unit of return is used in finance by corporates in any form of investment like assets, projects etc.

- Rate of return measure return on investment similar rate of return on assets, rate of return on capital etc.

- Rate of return is useful in making investment decisions.

- It is used in financial assay by investors.

Rate of Return Computer

You can utilize the post-obit Rate of Render Calculator

| Current Value | |

| Original Value | |

| Rate of Return Formula | |

| Rate of Return Formula = |

| ||||||||||

|

Rate of Return Formula in Excel (With Excel Template)

Here we will practice the same example of the Rate of Return formula in Excel. It is very easy and simple. Y'all need to provide the 2 inputs i.eCurrent Value and Original Value

Y'all can easily calculate the Rate of Return using Formula in the template provided.

Case #one

Case #2

Instance #3

Example #4

Conclusion

The rate of return is a popular metric considering of its versatility and simplicity and tin can exist used for any investment. Return of return is basically used to calculate the rate of return on investment and help to measure investment profitability. If the investment rate of return is positive then it's probably worthwhile whereas if the charge per unit of render is negative then it implies loss and hence investor should avoid it. The higher the percentage greater the benefit earned. One thing to go along in mind is considering the fourth dimension value of coin. For simple purchase or sale of stock the time value of money doesn't affair, but for calculation of fixed nugget like building, home where value appreciates with time. So, the annualized rate of return formula is used. Ane can use rate of render to compare performance rates on capital equipment purchase while an investor can calculate which stock purchases performed improve

Recommended Articles

This has been a guide to a Rate of Return formula. Here we discuss its uses along with practical examples. We too provide you with Charge per unit of Return Calculator with downloadable excel template. You may also look at the post-obit manufactures to acquire more than –

- Debt to Income Formula

- Formula for Capital Gains Yield

- Guide to Bid-Ask Spread Formula

- Formula for Capacity Utilization Charge per unit

- Annual Return Formula | How to Summate? | Example

Source: https://www.educba.com/rate-of-return-formula/

Posted by: dominguesmazing.blogspot.com

0 Response to "How To Calculate Annual Rate Of Return In Excel"

Post a Comment